mortgage refinance transfer taxes

You originally obtained your loan when the lending limit was less than the 2022 Home Equity Conversion Mortgage HECM limit of 970800 and your value is at or higher than the HUD limit especially the limit that was in effect at the time you closed your loan. When you owe the IRS taxes they can apply a claim on all of your property not just your house with a general lien.

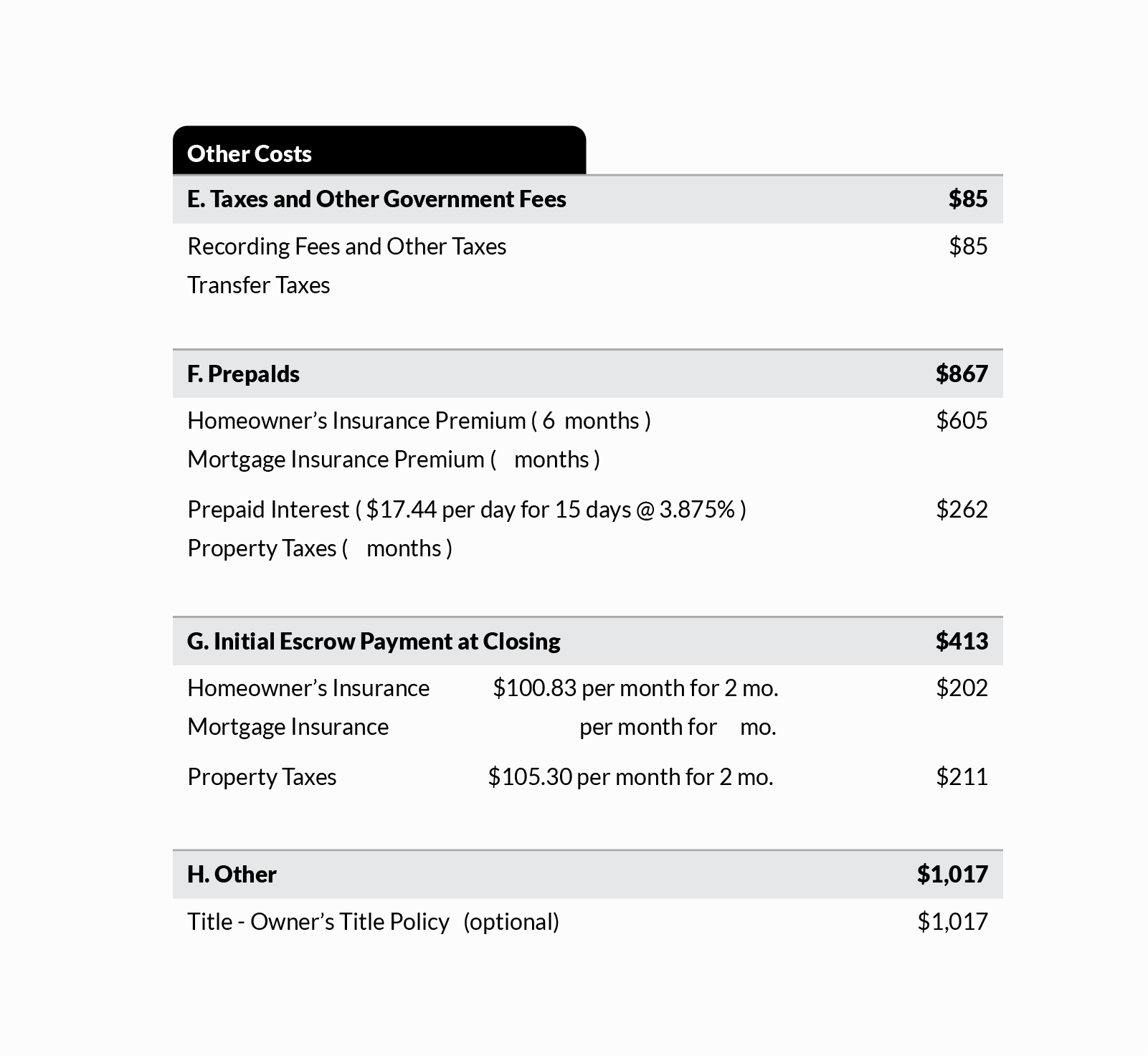

Understanding Mortgage Closing Costs Lendingtree

Down payment assistance programs may not be available in your area.

. 0 APR Credit Cards. A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan based.

995 EXPRESS Refi fee waiver available for EXPRESS Refi transactions only. When interest rates drop consider refinancing to shorten the term of your mortgage and pay significantly. Getting a mortgage with a lower interest rate is one of the best reasons to refinance.

Mortgage insurance protects your lender if you default on your mortgage. Typically a buyer with a high credit score high. In general your realtor.

Closing costs often entail taxes and fees associated. That tax is 070 per 100 of the money paid for the property. In contrast a specific lien is a claim on a particular piece of property or asset.

EXPRESS Refi products are available for loans up to 11 Million. Conventional loans have private mortgage insurance while loans insured by the Federal Housing Administration or FHA have mortgage insurance premiums. The interest rate is essentially the fee a bank charges you to borrow money expressed as a percentage.

Calculate the monthly interest rate. The Loan term is the period of time during which a loan must be repaid. Theres a transfer tax any time youre preparing documents that transfer an interest in real estate.

ARMs transfer the risk of rising interest rates to youthe homeowner. Your home value has increased considerably. Is now the right time for your mortgage refinance.

Some programs require repayment with interest and borrowers should become fully informed prior to closing. Offer is subject to credit approval and underwriting and is subject to change or termination at any time without notice. The one exception to this is Miami-Dade County where the rate is 060 per 100 of value.

Balance Transfer Credit Cards. Form TP-584 Combined Real Estate Transfer Tax Return Credit Line Mortgage Certificate and Certification of Exemption from the Payment of Estimated Personal Income Tax should be filed with the county clerk where the property is being sold and is due no later than the 15 th day after the delivery of the deed. Purchase loans a refinance of an existing PFFCU portfolio loan or loans where there is a change to title do not qualify.

Refinancing costs usually dont include property taxes mortgage insurance and home insurance because those. Down payment assistance amount may be due upon sale refinance transfer repayment of the loan or if the senior mortgage is assumed during the term of the loan. When its a good idea to refinance your mortgage Generally if refinancing will save you money help you build equity and pay off your mortgage faster its a good decision.

Whether you want a lower interest rate or shorter loan term find out when a refinance is worth it. For example a 30-year fixed-rate loan has a term of 30 years. When to consider a refinance of your reverse mortgage.

However there are other mortgage-related Florida taxes worth knowing about. If youre considering a refinance a good mortgage rate is considered 075 to 1. For instance a specific lien might be incurred when a property owner owes homeowners association HOA fees or late mortgage payments on a.

Deducting mortgage points on a cash-out refinance Also called discount points mortgage points are essentially upfront fees you pay a lender in return for a lower interest rate on your loan. Homebuyers who put down less than 20 are required to pay mortgage insurance as part of their monthly mortgage payment.

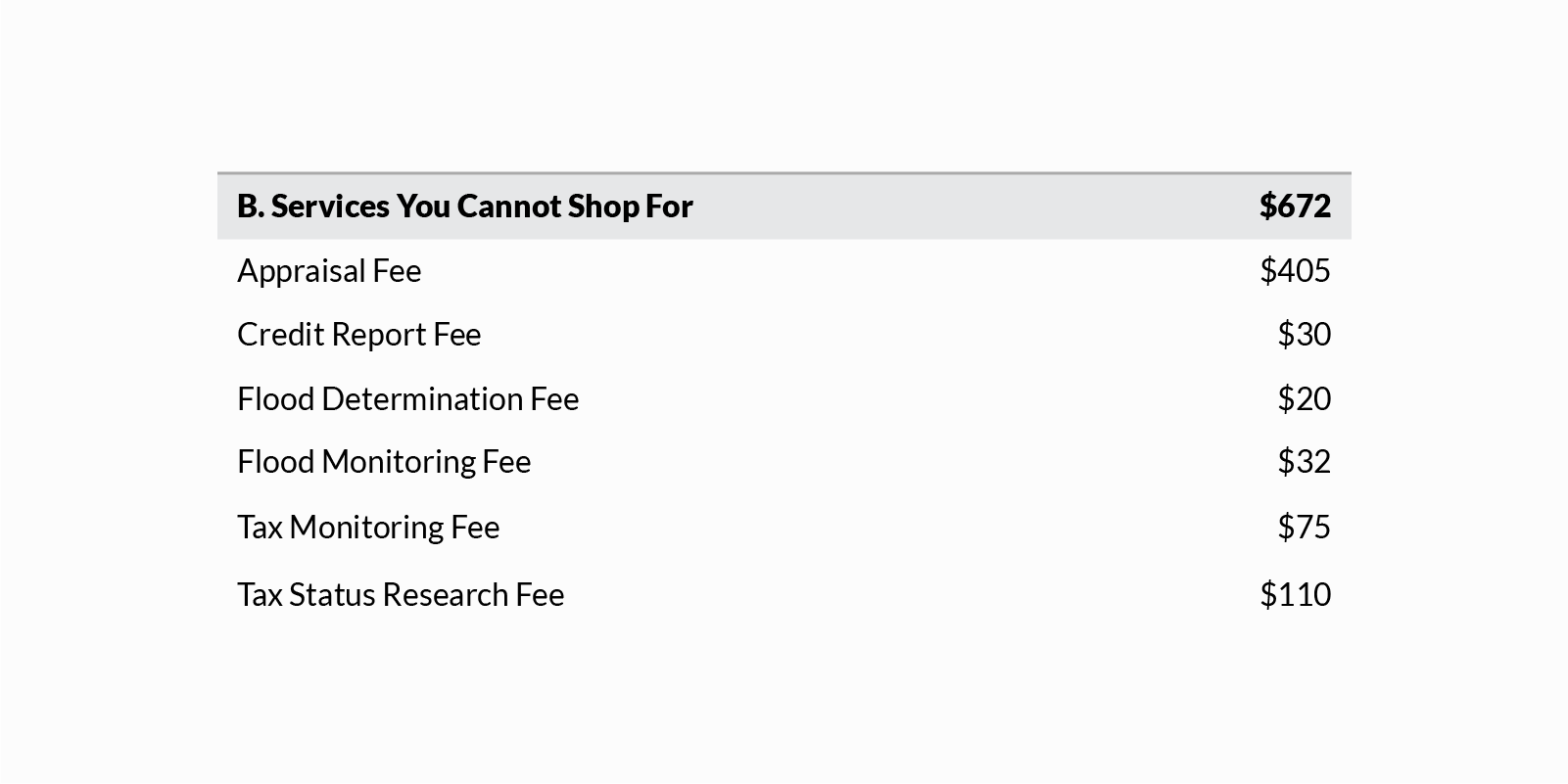

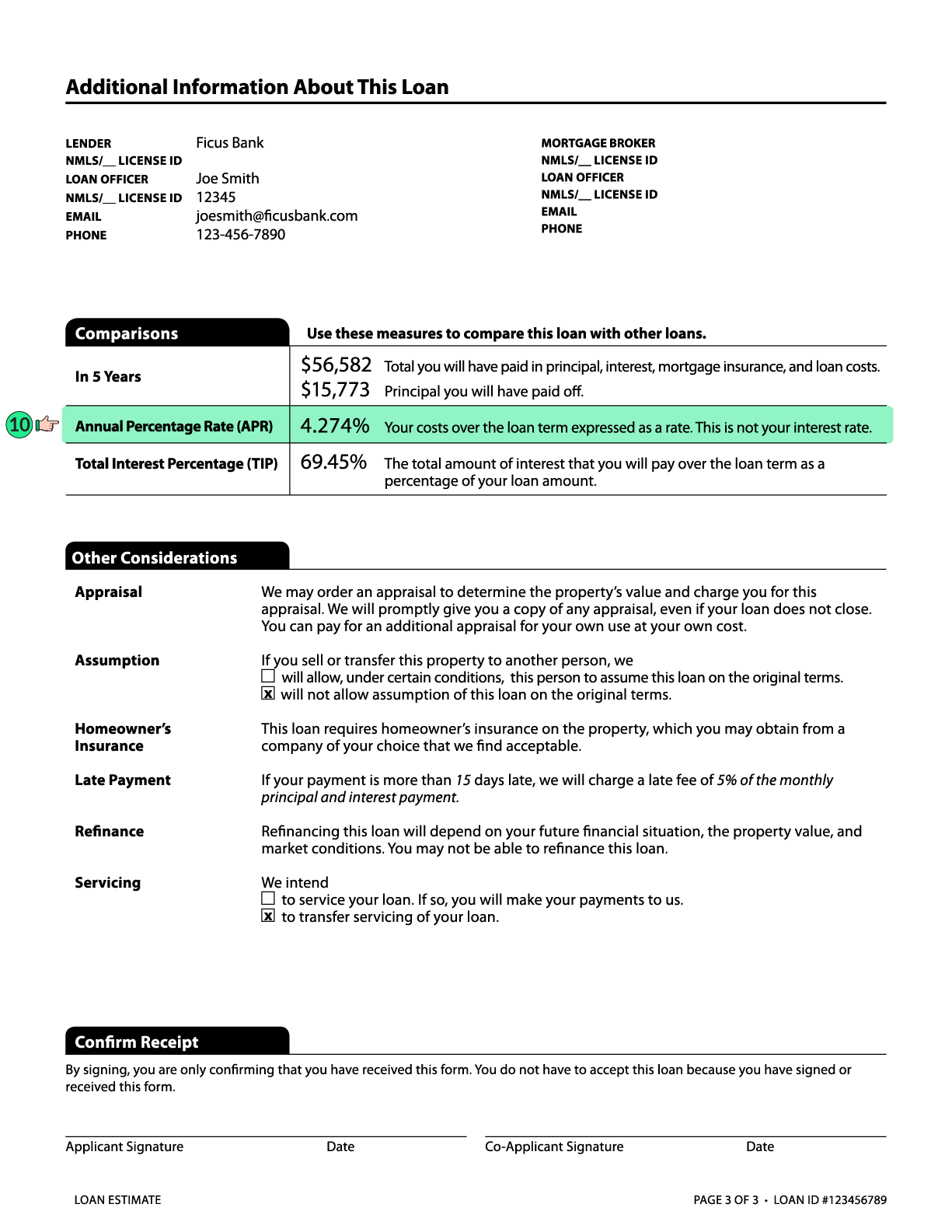

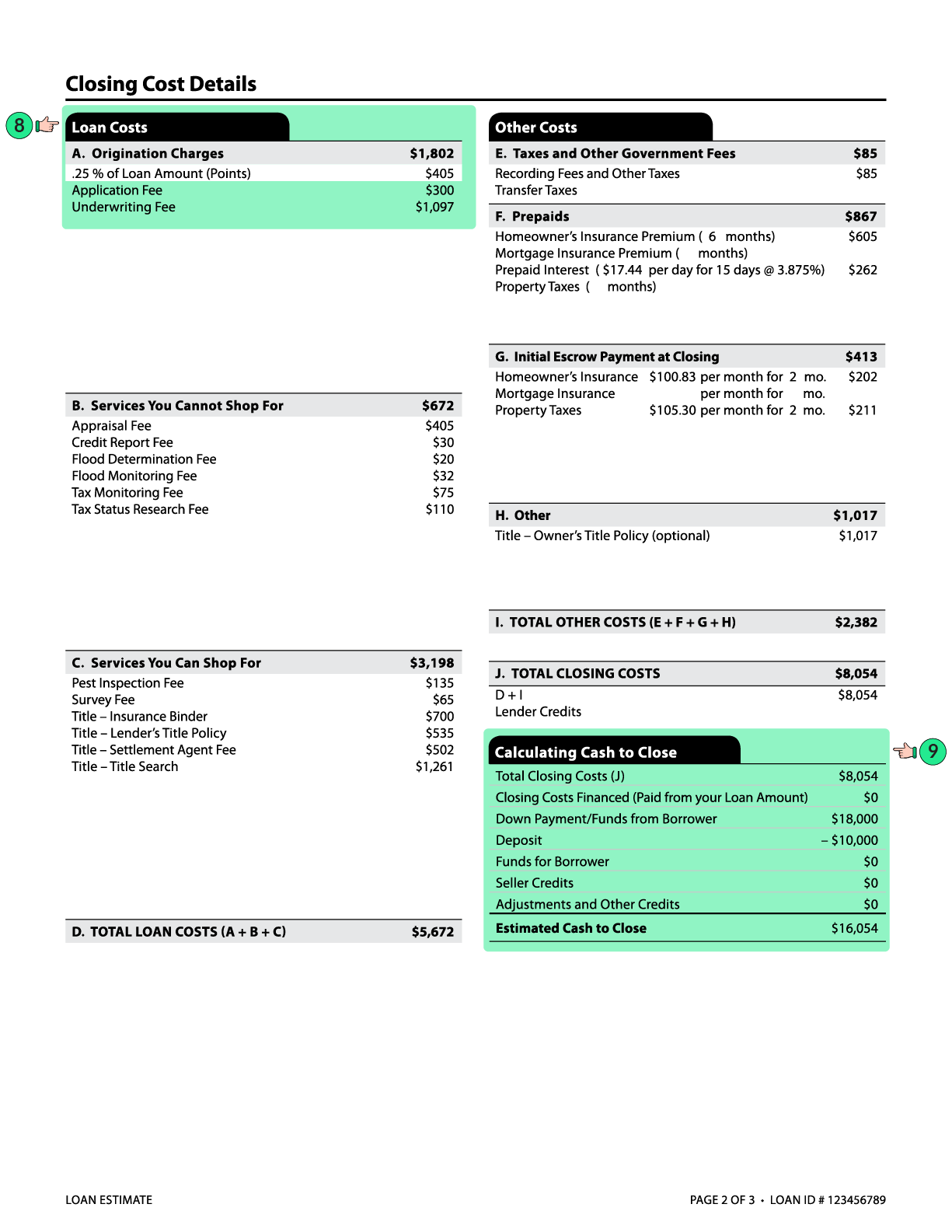

What Is A Loan Estimate How To Read And What To Look For

Delaware First Time Home Buyer State Transfer Tax Exemption Prmi Delaware

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Are Real Estate Transfer Taxes Forbes Advisor

Bc Property Transfer Tax 2022 Calculator Rates Rebates

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Is A Loan Estimate How To Read And What To Look For

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

Understanding Mortgage Closing Costs Lendingtree

What Are Deed Transfer Taxes Smartasset

Understanding Mortgage Closing Costs Lendingtree

Refinancing Your House How A Cema Mortgage Can Help

Delaware First Time Home Buyer State Transfer Tax Exemption Prmi Delaware

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Is A Loan Estimate How To Read And What To Look For

What If My Co Purchaser And I Don T Both Qualify As First Time Homebuyers Ratehub Ca

What Are Deed Transfer Taxes Smartasset

Closing Costs That Are And Aren T Tax Deductible Lendingtree